Select Winners, Scale winners, Sell winners

Executive Summary

Wave Hanson Fund I is a $20 million venture fund built on a simple but powerful thesis: sustainability will drive the next wave of venture winners – specifically, startups that outperform incumbents on cost, sustainable by design, and scale rapidly will yield outsize returns. We invest globally in early-stage (pre or post-revenue, pre-Seed to Series A) companies that meet our three core criteria: cheaper than alternatives, sustainable from the ground up, and simple to scale. By focusing on ventures that deliver both economic and environmental advantages, we believe we can identify the next generation of market leaders that will dominate their industries while healing the planet. In the coming decade, these “sustainability at a superior cost” startups are poised to capture unprecedented consumer demand, benefit from massive technological tailwinds, and command premium valuations – setting the stage for venture capital success.

Our investment strategy is encapsulated in “Select Winners, Scale Winners, Sell Winners.” We select only the most promising ventures that fit our thesis, scale them through active, hands-on support and follow-on capital, and sell (exit) at the optimal time to deliver exceptional returns to our investors. This proactive approach, combined with clear investment criteria and deep sector focus, positions Wave Hanson to not only achieve top-tier financial performance but also drive measurable positive impact. The following thesis document details our market rationale, criteria, focus sectors, strategy, and examples that illustrate why sustainability-led startups – when offering superior unit economics – will lead markets and reward investors. It serves as the foundation for our fund’s strategy and a persuasive case for our limited partners (LPs) that investing in sustainable scalability is both transformative and very lucrative.

Market Opprotuntiy:

The Sustainable Revolution is HAPPENING Now

Global markets are undergoing a fundamental shift toward sustainability. Climate change, resource scarcity, and consumer preferences are transforming how industries operate and what products and services succeed. This shift represents a once-in-a-generation investment opportunity. Just as the internet boom and mobile revolution created trillion-dollar companies, the “sustainability revolution” is now accelerating and poised to dominate the coming decades. Consider a few macro indicators:

Massive Capital Flows: Environmental, social, and governance (ESG) investing has moved mainstream. ESG assets are on track to exceed $50 trillion by 2025, over a third of global AUM bloomberg.com. Venture capital has followed suit: global climate-tech VC funding surged from almost nothing a decade ago to $70 billion in 2022 statista.com. In 2023, despite a broader VC downturn, climate tech’s share of private investment rose to ~11%, extending a decade-long uptrend pwc.com. Investors recognize that solving sustainability challenges can yield enormous financial returns.

Urgent Need & Policy Tailwinds: Achieving global climate goals and resource security will require trillions in investment. McKinsey estimates roughly $275 trillion will need to be spent between 2021 and 2050 to reach net-zero emissions mckinsey.com. Governments are responding with unprecedented support – from the US Inflation Reduction Act’s $369B for clean tech, to the EU Green Deal and global pledges to deploy renewables. These policies de-risk sustainable technologies and create huge markets for innovators. As one example, 85% of new electricity generation added worldwide in 2023 came from renewables, totaling 473 GW of clean power installed in one year thebusinessdownload.com. This shift is fueled by both policy and the compelling economics of green energy (explored below).

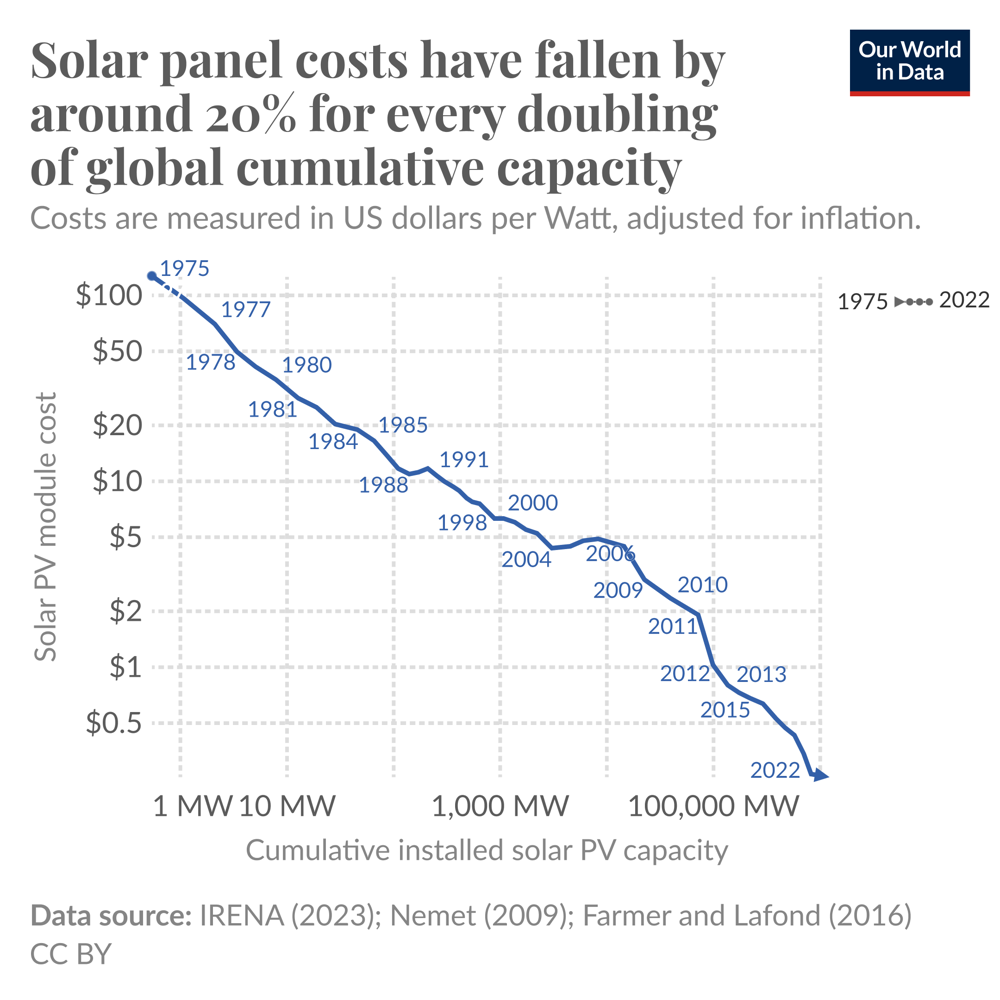

Solar PV module cost has dropped exponentially over time – roughly 20% with each doubling of cumulative capacity (1975–2022). This learning-curve effect led to solar panels becoming ~90% cheaper in the last decadeourworldindata.org. Such cost declines have transformed clean technologies from expensive niche options into cost leaders; today solar and wind are often the least-cost energy sources, beating fossil fuels on price in many regionsourworldindata.org. Falling tech costs mean sustainable startups can outprice incumbents, driving mass adoption.

Technological Breakthroughs Driving Costs Down: We are at an inflection point where many sustainable technologies are not only viable – they are cheaper than legacy solutions. Renewable energy is a prime example. Over the last decade, solar photovoltaic costs fell ~90%, onshore wind costs ~70%, and battery costs by more than 90% ourworldindata.org. These dramatic cost declines follow learning curves that make sustainable tech increasingly cost-competitive with scale. Solar power, once one of the most expensive energy sources, is now the cheapest form of new electricity in many countries ourworldindata.org. Similarly, on a leveld basis, new solar and wind power are often 50–60% cheaper than fossil fuel power today irena.org. In 2023, 81% of new renewable power capacity added globally was cheaper than the cheapest new fossil fuel alternative – a remarkable tipping point irena.org. This pattern is repeating across sectors: the cost of sustainable innovation is plummeting, eliminating the “green premium” and instead creating a green discount advantage.

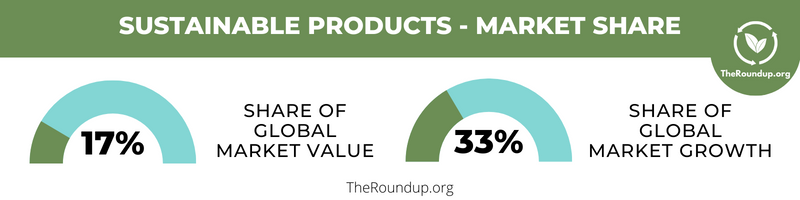

Sustainably marketed products are capturing an increasing share of consumer markets. They now represent 17% of total market value but an outsized 33% of growth theroundup.org. In short, one-third of new consumer spending is going to sustainable products. This reflects a secular shift in demand favoring eco-friendly options. Startups that leverage this trend – offering sustainable goods that are also affordable – can ride a wave of organic growth fueled by consumer preference.

Consumer Demand and Market Growth: Consumers are voting with their wallets for sustainability. Environmentally friendly products are capturing a rising share of market across industries, from food to fashion to household goods. Products marketed as sustainable now account for 17% of global market value – up from ~13% in 2015 – and critically, they drive 32% of market growth theroundup.org. In consumer packaged goods, sustainability-marketed products grew 2.7× faster than their conventional counterparts (7.3% vs 2.8% CAGR) theroundup.org. This outperformance shows that companies embedding sustainability into their offerings are winning market share. Moreover, multiple surveys indicate 60–70% of consumers prefer to buy sustainable products, and a majority are willing to pay a premium for eco-friendly alternatives pwc.com theroundup.org. The takeaway: there is a large and growing customer base for green solutions, and where price parity (or superiority) is achieved, sustainable options can rapidly overtake incumbents.

Corporate and Industrial Adoption: It’s not just consumers – corporations are also driving the sustainability revolution. Over 1,500 large companies have set net-zero targets, and industries from automotive to agriculture are seeking greener inputs and processes. This creates enormous B2B opportunities for startups that can supply cheaper, cleaner alternatives. For example, automakers need sustainable materials (like recycled batteries, bioplastics), agribusinesses seek regenerative practices, and consumer goods companies are desperate for low-cost biodegradable packaging to meet their pledges. Incumbents increasingly partner with or acquire innovative startups to meet these goals. A notable case: Google’s $3.2 billion acquisition of Nest Labs (maker of smart thermostats) in 2014 brought an energy-saving device into millions of homes under Google’s umbrella reuters.com. Strategic acquisitions of sustainability startups are on the rise, as established players realize buying “green disruptors” can be the quickest path to innovation. This trend provides fertile exit opportunities (and competitive bidding) for the companies we invest in.

In sum, the convergence of huge capital inflows, urgent global needs, plummeting technology costs, and surging demand for sustainable solutions underpins an unprecedented market opportunity. We believe the stage is set for sustainability-focused ventures – especially those that can beat the status quo on price and scalability – to capture massive value. Wave Hanson is positioned to seize this moment by backing the startups that will lead this transformation.

Thesis in Focus: Cheaper, Sustainable, Scalable – or No Deal

Wave Hanson’s investment criteria are strict and unapologetic. We seek out startups that meet all three of our core criteria:

Cheaper Than Alternatives – They offer a product or service that is more cost-effective than the incumbent solution (or have a clear path to that within a realistic timeframe). This could mean lower unit costs, better lifetime value, higher efficiency, or simpler logistics that drive costs down. Importantly, “cheaper” is evaluated on true apples-to-apples economics, without relying solely on subsidies or premiums. Our companies compete on fundamental unit economics. This criterion ensures our portfolio companies can win in the market on price and profit margin, not just on goodwill. It aligns sustainability with economic self-interest for customers. When a solution is both green and saves money, adoption becomes a no-brainer. For example, renewable power beating coal on cost has led to exponential growth in clean energy installations irena.org – economics drive scale. We look for analogous dynamics in every sector (e.g. a biodegradable material that costs less than plastic to produce, or a water filtration system that delivers clean water at lower cost per liter than competitors). This focus guards against the mistakes of “Cleantech 1.0” where many startups had great ideals but could not compete on cost. Our companies win on merit, not just morals. As At One Ventures – a leading climate tech fund with a similar philosophy – puts it, we invest in startups using technology to “upend the unit economics of established industries while dramatically reducing their planetary footprint.” atoneventures.com

Sustainable by Design – The company’s core product or service must directly embody environmental sustainability or regeneration. This is not about token ESG measures; it’s about baked-in impact. We back businesses whose success inherently means a cleaner, healthier planet. Their solutions might slash carbon emissions, reduce waste, restore ecosystems, or enable circular economies. Crucially, this impact should be measurable – we and the startup should be able to quantify how each unit sold or deployed benefits the environment (e.g. kilograms of CO₂ avoided, liters of water saved, hectares of land restored, etc.). By filtering for “impactful by design” companies, we avoid greenwashing and ensure our portfolio aligns with major environmental value drivers. Many Wave Hanson companies will be in climate tech, but we also include broader sustainability (biodiversity, resource efficiency, pollution reduction, etc.). We share the view of At One Ventures that impact extends beyond carbon to areas like water, soil, and biodiversitynvca.org. Every investment we make must help humanity become net-positive to nature as it scales – this is a non-negotiable part of our thesis.

Simple to Scale – The solution must be inherently scalable and deployable without prohibitive friction. We favor business models and technologies that can grow rapidly to global scale. This often means software-enabled hardware, modular systems, or platform approaches that avoid one-off project risk. We evaluate whether the startup can multiply its impact quickly: Are the supply chain and materials readily available? Can manufacturing be ramped up with existing processes? Does the product have a short sales cycle or viral adoption potential? Are there network effects? Essentially, we look for straightforward paths to go from early pilots to mass market. If a product is amazing and green but requires a rare mineral or a $1B factory for each new market, scaling will stall. In contrast, if it’s a “drop-in” replacement (e.g. a sustainable material that runs on existing production lines) or leverages existing infrastructure (e.g. software layered on ubiquitous hardware), scale can happen fast. Simplicity also extends to the business model – we prefer companies with focused offerings that solve a specific problem extremely well, rather than overly complex solution bundles that are hard to replicate. By selecting for scalability, Wave Hanson ensures that our companies aren’t just science experiments – they are poised to grow 10×, 100×, 1000× in revenue and impact. This is how we drive venture-scale returns and global environmental benefits in parallel.

These criteria form our investment triad. Every deal must check all three boxes: Cost Superiority, Sustainability, Scalability. This high bar means we say no far more often than yes, but it also means the portfolio we build is exceptionally high-quality and aligned with our thesis. Each Wave Hanson investment should be a potential category-defining “sustainability champion” with both moral authority and market authority. By being disciplined here, we de-risk our portfolio and tilt the odds of outsized success in our favor. It’s worth noting that this approach has strong precedents – funds like Congruent Ventures, Lowercarbon Capital, Pale Blue Dot, Breakthrough Energy Ventures, S2G Ventures, Astanor Ventures, Regeneration.VC, At One Ventures, FullCycle, The Yield Lab, have all demonstrated that targeting deep tech innovations which radically improve unit economics and reduce footprints yields game-changing companies. We aim to replicate and build on that success as a smaller, earlier-stage player identifying the winners of tomorrow.

Focus Sectors: Where We Find Our Winners

Wave Hanson applies the above criteria across a range of sectors where sustainability and cost disruption intersect. We maintain a global perspective on opportunities, looking at innovations from Silicon Valley to sub-Saharan Africa, but concentrate on industries that have both high environmental impact and high potential for tech-driven transformation. Our current sector interests include:

Regenerative Agriculture & Food Systems: Agriculture is responsible for a quarter of global emissions and massive land and water use. We seek agtech startups that help produce food more sustainably and cheaply. This includes soil regeneration technologies (e.g. microbiome solutions that restore soil health and boost yields at lower cost than synthetic fertilizers), climate-resilient crops (crops that outperform traditional growing cycles), and alternative proteins that can undercut animal products on price. We are especially interested in ventures bringing down the cost of plant-based or cell-based proteins to reach price parity with conventional meat – a key tipping point for mass adoption. An example is Climax Foods, which uses data science to create plant-based cheeses that aim to be tastier and eventually cheaper than dairy cheese. Another example is Monarch Tractor: an autonomous electric tractor that not only eliminates fuel costs and emissions, but through automation can save small farmers money on labor. Monarch’s tractors are hitting the market via a partnership with Foxconn to mass-manufacture them reuters.com, illustrating how sustainable ag equipment can scale and compete with traditional tractors on total cost of ownership. Wave Hanson also looks at indoor farming and precision ag if they demonstrate clear cost/unit advantages (for instance, greenhouses that dramatically cut water and input costs). Overall, we invest in making the food supply chain more regenerative, efficient, and resilient – from soil to shelf.

Water & Low-Cost Sanitation: Clean water is both a fundamental human need and a growing crisis in many regions. We target low-cost water purification and distribution technologies that can provide safe water cheaper and more reliably than incumbent systems. For example, a startup that has developed a new membrane filter requiring minimal energy and with a longer lifespan than current filters would fit our thesis (cheaper maintenance, less waste). We also consider decentralized water systems (like solar-powered desalination units, or atmospheric water harvesters) if they can beat the cost of trucking or piping water in remote areas. An area of interest is modular water treatment – think small-scale wastewater recycling plants that factories or communities can deploy to save water and costs versus sending waste to centralized facilities. In sanitation, eco-friendly toilet or sewage solutions that are cost-competitive with traditional sewer expansion can have huge scalable impact in emerging markets. Essentially, we back the technologies that ensure clean water access and waste treatment at a fraction of the traditional cost, which not only addresses a $100+ billion market but yields significant health and environmental benefits.

Biodegradable Packaging & Circular Materials: The world is drowning in plastic waste, and regulators and consumers alike are seeking alternatives. Wave Hanson invests in companies creating biodegradable or bio-based materials that can replace plastics, foams, textiles, etc., often using waste or renewable inputs. The key, again, is cost parity or better with petroleum-based incumbents. One success story is Cruz Foam, which developed a compostable foam packaging (made from shrimp shell chitin) as a replacement for Styrofoam. Cruz Foam’s material is earth-digestible and achieved cost-competitiveness with petro-foam for select packaging needs; the company raised $18M in Series A to scale production with major packaging partners. Another portfolio we admire is Ravel, which built a closed-loop process to recycle polyesters and produce recycled PET fiber at a cost competitive with virgin polyester– while using 59% less energy. This kind of circular textile solution checks all our boxes. We are actively hunting for startups working on biodegradable plastics, compostable packaging films, recyclable composites, and innovative recycling tech (chemical recycling, enzymatic breakdown, etc.) that lower the cost of waste management. The broader theme is a circular economy for materials: we fund companies turning waste streams into valuable inputs, which both reduces pollution and creates profitable products. Examples include ventures converting agricultural waste into biodegradable plastic alternatives, or companies like Ascend Elements which recycles lithium-ion batteries and reintegrates 98% of critical metals back into new batteries nvca.org – a process that can significantly cut the cost and footprint of battery production. (Ascend Elements, notably, has raised over $700M and built a full-scale plant since its seed funding nvca.org, exemplifying how a circular tech that is economically superior can scale rapidly with market demand). Wave Hanson’s focus on circular materials ties directly to global supply chain needs: companies that can offer cheaper raw materials by recycling or bio-producing them stand to disrupt industries from packaging to construction.

Energy & Resource Efficiency: Given energy’s central role, we selectively invest in novel energy technologies that have a clear cost advantage. This includes energy storage breakthroughs (for instance, a battery chemistry using abundant materials like sodium or iron that can store power at a fraction of the cost of lithium-ion – Noon Energy, is working on exactly this: ultra-low-cost long-duration storage). We also consider distributed energy solutions like microgrid software or off-grid solar kits that bring power cheaper than diesel generators in emerging markets. (E.g., Okra Solar brings solar to off-grid households in Asia/Africa more affordably than extending the grid.) Beyond power, resource efficiency software – such as AI for industrial energy savings, or IoT for smarter building HVAC – can be very scalable and cost-driven. We target startups whose product can cut a client’s resource bills (energy, water, raw materials) significantly, paying for itself quickly. These efficiency solutions often have fast sales cycles and scale via enterprise adoption, aligning with our “simple to scale” principle. For instance, a company that uses machine learning to optimize heating and cooling in commercial buildings can slash energy use by 20-30% – if provided as a SaaS platform, it’s low friction to deploy and yields immediate cost savings for customers, driving rapid growth and climate impact. Wave Hanson looks for these win-win efficiency plays across manufacturing, buildings, and transportation.

Ecosystem Restoration & Carbon Tech: Finally, we keep an eye on startups restoring natural ecosystems or innovating in carbon capture provided they meet our cost criterion. This is admittedly a challenging area – many carbon removal or biodiversity projects are expensive or hard to monetize. But some manage to turn restoration into a scalable business. For example, Dendra Systems uses drones and AI to automate reforestation, aiming to restore land faster and cheaper than manual tree planting. Similarly, companies in regenerative forestry, ocean cleanup, or biodiversity monitoring can have viable models if they leverage technology to cut costs. We will invest in such ventures when they demonstrate a path to profitability via either market mechanisms (e.g., selling carbon credits at a cost below prevailing rates while restoring ecosystems) or through services that industries are willing to pay for (like pollination services, reef restoration for tourism/fishing, etc.). An illustrative case is Dalan Animal Health, which created the world’s first honeybee vaccine to prevent colony collapse nvca.org. Bees pollinate one-third of our food supply; Dalan’s vaccine improves bee survival, which has huge economic value for agriculture. By charging farmers/beekeepers for healthier hives (a cost offset by higher crop yields), Dalan built a scalable, revenue-generating model that also safeguards biodiversity. It’s these kinds of clever models – where conservation and profit align – that we seek out.

Across all these sectors, Wave Hanson’s sweet spot is where environmental impact areas intersect with disruptive economics. We do not chase every green idea; we focus on those with business models that can stand on their own feet. The sectors above are ones where we see abundant opportunities that fit our thesis today. Of course, we remain opportunistic – if a team comes to us with a groundbreaking way to, say, produce cement with zero emissions and at half the cost (a holy grail in construction), it would squarely hit our mandate. In fact, such a company exists in our network: Material Evolution developed a low-carbon cement from industrial waste that competes on price with Portland cement . The point is, by being clear in what we look for (cheaper, sustainable, scalable), we attract founders who share this ethos and filter for the sectors where this convergence is most feasible. We will continue to refine our focus areas as technologies mature and new environmental challenges emerge, but the core lens remains constant.

Investment Strategy: Select Winners, Scale Winners, Sell Winners

Our strategy for delivering outsized returns is encapsulated in three phases: Select, Scale, Sell. This is not a passive, spray-and-pray approach – it is an active, lifecycle strategy to maximize the success of each investment.

Select Winners: Everything starts with sourcing and picking the right companies. Wave Hanson takes a highly proactive and rigorous approach to deal selection. We leverage our global network of founders, industry experts, and partner funds to find the very best early-stage sustainability startups fitting our thesis. Given our criteria, our due diligence goes beyond typical team/market checks – we dive deep into unit economics, engineering feasibility, and impact metrics. Our team’s composition reflects this need: we have domain experts in engineering, science, and manufacturing alongside finance professionals, enabling us to assess hard-tech businesses with a high degree of competency. We ensure technical diligence is front and center. By thoroughly vetting the technology and cost structure, we gain conviction on which startups are true “winners” – those that can achieve a 10x improvement in impact and economics. We then lead or participate in their early funding rounds with check sizes from $50K (for pre-seed or initial pilot capital) up to $500K (seed/Series A co-investment). Our relatively small fund size means we can be selective: we anticipate a portfolio of around 20–30 companies, allowing each to receive meaningful attention. It also means we often co-invest with larger climate funds or generalist VCs; our edge in selection is our thesis alignment and expertise – we bring deals that others might overlook because we see the cost-disruption potential early. Notably, we prioritize startups that are post-revenue (even if just pilot sales) at the time of investment. This ensures some market validation is in place and that the company is already thinking about scalability and unit economics. It filters out purely R&D projects and focuses our capital on companies ready to grow. By carefully selecting only those startups that hit our trifecta (cheaper, sustainable, scalable) and show initial traction, we create a strong foundation for the portfolio.

Scale Winners: Selection is just step one. Once we invest, Wave Hanson is exceptionally hands-on in scaling our companies. We don’t just bet and wait; we actively work to de-risk and accelerate each venture’s growth. This hands-on approach is a core differentiator of our fund. It includes:

Strategic Guidance & Milestone Planning: We work with founders to develop clear milestones (technical and commercial) and a roadmap to achieve them. This often involves refining go-to-market strategies, pricing models (especially ensuring they capture the “cheaper” advantage properly), and laying out plans for capacity expansion.

Operating Support: Our team and network provide hands-on help in areas critical to scaling. We have advisors experienced in manufacturing scale-up, supply chain management, and operations to help a hardware startup move from prototype to mass production. We also assist with customer introductions, pilot programs, and partnership development – for example, helping a packaging startup connect with large consumer brands, or a clean cement company partner with a big construction firm. Additionally, we can support on hiring key talent (executives or specialist engineers) through our network. Essentially, Wave Hanson acts as an extension of the startup’s team in the early days, plugging gaps and facilitating progress.

Follow-on Capital and Syndication: We reserve a significant portion of our $10M fund (up to 50%) for follow-on investments in the most promising companies (“winners”) as they raise larger rounds. When a portfolio company is hitting its milestones and demonstrating leadership, we double down – not just with our capital but by helping syndicate larger rounds from top-tier investors. Our goal is to ensure our winners have the fuel to scale rapidly. For instance, if one of our seed investments is showing strong revenue and impact, we might lead or strongly participate in a Series A, and bring in our contacts at larger climate-focused funds or corporates to join. By doing so, we maintain meaningful ownership and support the company through critical growth phases. This approach of concentrating capital on winners is a proven method to drive portfolio returns in venture.

Platform Building: Over time, we aim to build a platform of resources for our startups, akin to what larger funds do – but tailored to early sustainability companies. This could include template libraries (for impact measurement, for customer ROI calculations), group workshops with experts (e.g. navigating regulations like plastic bans or carbon accounting rules), and peer-to-peer forums for founders to share learnings. The idea is to amplify what each company can do by leveraging the collective knowledge and network of our fund.

In short, when we scale winners, we throw our weight behind them. This increases the chances of success and helps them reach the “escape velocity” needed to outgrow competitors. It’s worth noting that in climate and sustainability sectors, scaling physical products or new hardware can be challenging – but that is exactly why our involvement is crucial. By actively mitigating risks (technical, operational, market) and providing growth expertise, we turn our selected startups into true scale-ups. Our team’s prior experience in growing businesses (for example, members have scaled startups to acquisitions, or led R&D at major firms) is a key asset here. We subscribe to the approach that venture investors must sometimes roll up their sleeves – especially in impact-driven companies where the path can be non-traditional. Wave Hanson is prepared to do that.

Sell Winners: Venture returns are only realized when we exit investments. Wave Hanson plans for exits from the start and takes a strategic approach to selling winners at the right time and value. Because we invest at early stages, our typical holding period might be ~5-7 years, but we remain flexible. Our focus is on achieving liquidity events that maximize value – whether through acquisition, IPO, or secondary sales. Given our thesis, many portfolio companies could become attractive acquisition targets for larger corporations seeking sustainable solutions. We proactively cultivate relationships with likely acquirers in each sector (for instance, chemical companies for materials startups, agri-food conglomerates for alt-protein startups, auto/energy companies for relevant tech, etc.). By keeping these potential buyers updated on our companies’ progress (with founder permission), we set the stage for eventual acquisition interest when the startup achieves key milestones. We’ve seen this play out in the market: sustainable innovators often get snapped up at high multiples once they’ve proven their tech – Google’s $3.2B purchase of Nest reuters.com or Monsanto’s $1B+ acquisition of Climate Corp are prior examples of large firms paying a premium to acquire green tech pioneers. We aim for similarly favorable exits. Another route is IPO or SPAC – the public markets have shown appetite for sustainability leaders (for instance, Beyond Meat’s IPO soared 163% on day one washingtonpost.com, reflecting investor hunger for plant-based innovation). While not every company will IPO, those that can become market leaders in their niche could go public and deliver huge returns. We guide founders on what milestones are needed for an IPO (revenue scale, margins, etc.) and help them position accordingly if that path makes sense. Finally, we consider secondary sales (selling our stake to later-stage investors) as a tool for return management – if a company is doing well but still years from exit, we might sell a portion of our holding in a growth round to return capital early, while retaining some upside. Our agile approach to “sell winners” is about balancing patience with opportunity – we won’t rush to exit a future unicorn, but we also won’t hold indefinitely if an attractive return can be locked in. We measure success fund-wise by DPI (cash returned) and IRR, so executing timely exits is crucial. By planning for exit routes (who might buy, when to IPO) from the outset, we ensure our companies and investors are aligned toward ultimate liquidity events.

This Select-Scale-Sell cycle is designed to produce outsize returns on a $10M fund. We essentially curate a portfolio of high-upside bets, heavily support them to boost their value, and then realize that value through savvy exits. Not every company will be a winner, of course – venture portfolios follow a power-law where a few big wins drive the majority of returns. Our strategy acknowledges this: we invest small initial checks in a range of companies (selecting those with potential), then double-down resources on the subset that truly excel (scale them), and concentrate our exit efforts on harvesting those successes (sell). This way, even if only, say, 20% of our companies achieve breakout success, the fund can deliver a 5x+ overall return. In fact, climate tech startups as a category have shown strong performance – according to recent analyses, they’ve achieved a median IRR of ~25% over the past 5 years, outpacing traditional VC clockwork.app. With our hands-on approach, we aim to surpass even those benchmarks.

Lastly, our “scale winners” philosophy doesn’t just help returns – it also amplifies impact returns. By helping our best companies grow faster, we are accelerating the environmental benefits they deliver. A single Wave Hanson portfolio company at scale might eliminate millions of tons of CO₂ or save thousands of liters of water. Thus, our strategy creates a positive feedback loop: the bigger the winner, the bigger the impact, and the bigger the financial upside. This is how we engineer a portfolio that succeeds on multiple bottom lines.

Track Record & Case Studies: Proof That It Works

While Wave Hanson is a new fund, our thesis is validated by real-world success stories in the market and within our team’s experience. Many of today’s most valuable sustainable startups and exits exemplify the very premise we are investing in: sustainability sells when it outcompetes on cost/quality. Below, we highlight a few examples that showcase how focusing on cheaper, scalable, planet-positive innovation can lead to tremendous business outcomes:

Ascend Elements (Battery Recycling) – Cheaper Circular Economy at Scale: Ascend Elements developed a process to recycle used lithium-ion batteries and recover 98% of critical metals, then feed those materials back into new battery production nvca.org. This technology is sustainable (it addresses battery waste and mining impact) and economically game-changing – it can supply battery-grade metals at lower cost than freshly mined materials. Since it’s pre-seed round, Ascend Elements has raised over $700 million in follow-on capital nvca.org, is operating at full production, and has become a linchpin of the EV supply chain in the U.S. The company is now valued in the unicorn range. This success story proves the thesis: a circular, eco-friendly solution that undercuts incumbent costs (mining and refining) scaled rapidly and attracted major investment, likely positioning early investors for enormous returns. Wave Hanson seeks to fund the next Ascend Elements in other domains – companies that can flip a high-cost, high-waste process into a low-cost, clean one, and thereby take over the market.

Beyond Meat (Plant-Based Meat) – Consumer Demand for Sustainable + Tasty: Beyond Meat isn’t in our portfolio, but its trajectory is instructive. By creating plant-based proteins that mimic meat, Beyond Meat targeted sustainability (reducing emissions and resource use of animal agriculture) and aimed to eventually compete with animal meat on taste and cost. Its early success with consumers and strong growth led to an IPO in 2019 that stunned Wall Street – Beyond Meat’s stock surged 163% on its first day washingtonpost.com, making it one of the best IPOs in decades and lifting its market cap to nearly $4 billion. This reflected investor recognition that a massive market was ripe for disruption. While Beyond Meat still works on achieving cost parity with meat, its rapid sales growth (doubling revenue year-over-year at the time of IPO washingtonpost.com) and brand leadership allowed it to command a premium. Early venture backers who believed in sustainable food earned huge multiples on their investment as the company’s valuation skyrocketed post-IPO. However, we also learn from Beyond Meat’s story the importance of the cost angle – to maintain growth, they and competitors will need to get prices down. Wave Hanson’s focus in alternative protein is precisely on startups that can not only win on mission, but win on margin. The massive investor interest in Beyond Meat shows the market’s belief in sustainable food as a category; we intend to back the next generation of companies in that space that combine vision with superior unit economics.

Nest Labs (Smart Thermostat) – Energy Efficiency Meets Big Tech Exit: Nest Labs tackled home energy waste by inventing a smart thermostat that learns users’ habits and optimizes heating/cooling, saving energy (and money). Nest’s device was elegant and user-friendly (founded by ex-Apple designers), providing a better consumer experience than traditional thermostats. Crucially, it delivered cost savings on energy bills for users – paying for itself over time – while contributing to lower carbon emissions. Nest grew explosively in the early 2010s, and in 2014 Google acquired Nest for $3.2 billion in cash reuters.com. This was a landmark deal in the “clean tech” space, signaling that major tech companies saw value in green consumer tech. For Nest’s venture investors, it was a home run exit (it was reportedly valued around ~$800M in its last VC round, so Google’s purchase was a large step-up). The Nest story underscores how selecting a common appliance and making it dramatically more efficient and smarter can create a huge business. Wave Hanson looks for similar opportunities: products that improve efficiency in daily life (or industry) so much that they become must-haves. When they reach that status, incumbents or big new entrants will pay top dollar to acquire them. Google’s motivation was not just Nest’s current sales, but the strategic value of a foothold in smart homes and the talent behind it reuters.com. Likewise, many Wave Hanson companies could have strategic value far beyond their immediate revenue – e.g., a water tech startup might get acquired by a large utility company not only for its tech, but to integrate and modernize the utility’s services. We keep these strategic angles in mind and cultivate them as part of our exit planning.

Monarch Tractor (Electric Tractors) – Disrupting Farming Costs: Monarch Tractor, mentioned earlier, developed a fully electric, autonomous tractor aimed at small- and mid-size farms. Their tractors reduce labor costs (by automating tasks) and eliminate fuel costs, offering potentially several thousand dollars of savings per year per tractor for a farmer, while also cutting emissions and noise. After proving their prototype in pilot programs, Monarch achieved a major scale milestone: a manufacturing partnership with Foxconn to build their tractors at an automotive-grade factory in Ohio reuters.com. They also attracted strategic investment from CNH Industrial (a global tractor maker )reuters.com. This progress signals that Monarch’s solution is both technically viable and hitting the cost points needed for adoption. If Monarch captures even a fraction of the multi-billion dollar farm equipment market, it could be a huge success. Early investors in Monarch (which included several agtech VCs and climate funds) have already seen significant mark-ups in value as the company moved from seed to Series B. The key takeaway: clean, automated technology in traditionally “dirty” industries like farming can scale fast when it demonstrably improves the customer’s bottom line. Farmers are extremely cost-sensitive; the fact that Monarch is gaining traction indicates the product is penciling out financially for customers in addition to its sustainability benefits. Wave Hanson will continue to back startups with this profile – heavy-industry disruptors that make operations cheaper and cleaner, because they can achieve rapid uptake and either become standalone leaders or very attractive acquisition targets for incumbent manufacturers.

At One Ventures Portfolio – Validation of Thesis at Scale: At One Ventures, led by Tom Chi, pioneered a very similar thesis to Wave Hanson’s (Tom calls it the “net positive to nature” investment approach with an emphasis on unit economics). In just a few years, At One has grown to $525 million AUM across two funds by finding startups that fit this mold nvca.org. They have backed over 40 companies, many of which have become standout successes in climate tech. The fact that At One could raise a second fund of $375M in 2023 nvca.org speaks to how compelling LPs found their results and pipeline. This is indirect validation that the “sustainability + superior economics” thesis works: it attracts great entrepreneurs, produces companies that raise big rounds, and gives LPs confidence to invest more. Wave Hanson is differentiated in being a smaller, early-stage focused fund, but we consider At One’s trajectory a proof point that a hands-on, thesis-driven approach in this space can yield top-tier venture returns. We cite their success stories and mirror aspects of their model (e.g., rigorous diligence, in-house experts for portfolio support) to give our LPs confidence that we are following a playbook that is already delivering results. Moreover, we have friendly ties with such funds, meaning we can often syndicate and collaborate rather than compete – an advantage that gives our portfolio companies access to larger capital pools when needed.

Public Market Out-performers: We also note that companies with strong sustainability value propositions have shown resilience and growth in public markets. For instance, Tesla, the electric vehicle pioneer, became the world’s most valuable automaker and delivered astronomical returns to early investors – it proved that an electric, sustainable solution can outcompete legacy players (Tesla’s market cap peaked above $1 trillion, rewarding VC backers and public shareholders many times over). Even legacy companies that pivot to sustainability see benefits: Ørsted, a Danish energy company, shifted from fossil fuel to wind power and saw its market cap increase several-fold in the transition. These examples from public markets reinforce that sustainability-led disruptors can achieve dominant positions and create immense shareholder value. Wave Hanson’s goal is to identify the next Tesla or Ørsted while it’s still an early-stage startup.

In summary, the evidence is on our side: when a company delivers a product that is greener and cheaper/better, it tends to gain market share quickly and generate strong financial returns. By systematically targeting such opportunities, Wave Hanson is aiming for a portfolio full of “impact unicorns.” Each individual success like those above can return the entire fund (or multiple times over). For our LPs, that means that even a small $10M fund can realistically aspire to venture-class returns. We have high conviction – supported by data, case studies, and our own experience – that this thesis will produce not only impactful companies but lucrative exits. It’s not just optimism; it’s already happening in the market, and we’re positioning Wave Hanson to capitalize on it.

Fund Structure and Portfolio Construction

Fund Size & Stage: Wave Hanson is a micro-VC fund with a target size of $10 million for Fund I. We intentionally chose this size to allow us to focus on our niche and generate a strong return on a smaller base of capital. At ~$10M, we can invest in a significant number of early deals, yet remain small enough that a single big win can return the fund several times over. We primarily invest at pre-seed, seed, and occasionally Series A. Within these stages, we focus on post-revenue companies – those that have at least some early revenues or pilot sales, indicating product-market fit is underway. Typically, our entry point is when a startup is raising a ~$1–3M seed round (we might put in $250–500K) or a <$1M pre-seed (we might put in $50–150K). We will also opportunistically join strong Series A rounds (with a $250–500K check) if the company squarely fits our thesis and we believe our involvement can still add value at that stage.

Check Sizes & Ownership: Our check sizes range from $50K up to $500K. The lower end ($50–100K) is for very early “toe-in-the-water” investments or participating in pre-seed syndicates, often to build a relationship with a promising team. The higher end ($250–500K) is for leading or co-leading seed rounds, or being a substantial participant in a Series A. With these check sizes, we target an initial ownership stake typically between 5% and 10% at seed (could be higher if we invest very early, or lower if joining a larger round). We plan to reserve roughly 50% of the fund for follow-ons, which means out of $10M, about $5M is initial checks and $5M is follow-on. This reserve will be concentrated in the top ~5–8 companies in the portfolio (the “winners” we scale), allowing us to defend or even increase our ownership in those companies through Series A and B. Our small fund size also means we are not overly dilution-sensitive; we are fine if later rounds dilute us as long as the company’s value is growing dramatically – our focus is on absolute return, not maintaining a set ownership at all costs. We anticipate the final portfolio will have on the order of 20–25 companies. This provides sufficient diversification (no single failure can sink the fund) while still allowing each investment to be meaningful. If we err, it will be on the side of a slightly more concentrated portfolio, as we believe in high conviction bets rather than a scattershot approach.

Portfolio Mix & Target Returns: We construct our portfolio with the expectation that:

~50% of companies may not reach a major exit (some will fail fast, others may stagnate or only achieve small exits). We essentially write those off in return modeling.

~30–40% of companies will achieve moderate success – perhaps exits in the range of 1–5× our invested capital in them. These might be acqui-hires or niche businesses that sell for, say, $50M (if we invested at a $10M valuation, that could be a 5× outcome). These moderate wins help return some capital.

~10–20% (i.e. 2 to 5 companies in a 25 company portfolio) will be big winners, with exit multiples in the double or triple digits (10×, 20×, 50×, etc.). These are the companies we aim to identify and scale aggressively. Even one or two of these can make the fund. For example, if one company returns 30× and we had $500K total invested, that’s $15M returned from one deal – 1.5× the fund. We are aiming even higher; we’d like our top winner to potentially return >3× the fund alone. That might mean a $30M+ outcome for us, which on a $10M fund is very achievable if the company reaches unicorn status and we hold a few percent at exit.

Our target fund return is in the range of 5×+ net multiple and 25%+ net IRR. We believe this is attainable given the stage (early, high-growth companies) and our thesis (targeting high-value problems with huge markets). In fact, as noted, climate tech startups overall have shown ~25% IRRs in recent years clockwork.app, and we intend to beat the average through careful selection and management. Because our fund is smaller than many VC funds, we don’t need any single investment to be a billion-dollar exit to do well (though we’ll certainly strive for those!). A few $100–200M exits can already put us in a good position. That said, we definitely have line of sight to potential unicorns in our portfolio if things go right – the kind of companies that could IPO or be bought for hundreds of millions to billions (as illustrated in the success stories). It’s worth emphasizing to LPs that a $10M fund with disciplined deployment can yield venture-like returns (or better), and possibly faster liquidity, since we might exit some winners earlier via acquisition. Additionally, our smaller size means we don’t have to chase later-stage rounds or pour huge sums – we stick to early, where the multiples are highest.

LP Alignment & Impact: We structured Wave Hanson to be aligned with our LPs’ interests. We cap our management fees and keep fund expenses lean, so that the majority of the $10M is going into investments, not overhead. Our team is small and mission-driven, and each member has skin in the game (GP commitment). We also recognize that many LPs in a fund like ours care about impact alongside returns. While our thesis is returns-first (we firmly believe impact and returns go hand in hand here), we will provide transparent reporting on the environmental impact metrics of our portfolio (aggregate CO2 mitigated, water saved, etc.). In fact, because our companies track these metrics inherently, we can roll them up for LPs. This means investors in Wave Hanson will not only potentially earn great financial returns, but can also demonstrate measurable impact from their allocation – a double win that many family offices and institutions now seek.

Team & Value-Add: Why Wave Hanson is Uniquely Positioned

Wave Hanson’s team brings together deep experience in technology, sustainability, and venture scaling. Our partners and advisors have built startups, led R&D teams, and managed venture portfolios before – collectively, we have decades of experience at the intersection of business and environmental innovation. This matters because investing in sustainable tech is complex: it requires understanding science/engineering fundamentals, market dynamics, and impact assessment. Our team includes, for example:

A climate-focused operator and venture builder, dedicated to accelerating hardware solutions that drive real-world sustainability.

A seasoned financial strategist with decades of experience in global risk management, ensuring rigorous portfolio discipline.

A venture connector who bridges investors and founders, aligning capital with high-impact opportunities.

An impact-driven capital raiser, building relationships with mission-aligned LPs worldwide.

A startup community builder, scouting innovative founders and forging strong founder networks.

A visionary technologist from Google X, pioneering rapid prototyping and deep-tech breakthroughs.

A serial entrepreneur and co-founder of Priceline.com, scaling companies to global market leadership.

An operations specialist, turning fast-growing startups into efficient, high-performance ventures.

A rising climate-tech influencer, leading investor relations and plugged into youth entrepreneurship networks.

A Dubai-based investor relations pro, opening doors to Middle Eastern capital and markets.

A polymath inventor and entrepreneur, steering big-picture strategy with a global business lens.

A social innovator, ensuring mission alignment and community impact remain front and center.

Collectively, this team differentiates Wave Hanson from other funds. We have dedicated capabilities in-house for everything a startup needs to succeed: from raising capital (through our global investor relations reach), to building product and scaling operations (through seasoned entrepreneurs and operators), to staying mission-aligned. Few funds our size can match the breadth and depth of this talent network. As a result, Wave Hanson consistently sources higher-quality deals (often getting early access via our community ties and reputation for founder-friendly support), supports startups post-investment more intensively (essentially acting as an extended part of the startup’s team, thanks to our venture studio model and expert advisors), and cultivates global LP relationships (bringing in capital and connections from around the world, which in turn open new doors for our companies). Each team member and advisor is deeply hands-on, whether it’s making a crucial introduction to close a sales deal, helping recruit a key executive, structuring an impact measurement framework, or strategizing a follow-on funding round. This is the Wave Hanson difference: we provide far more than money. We provide a platform of people – a world-class team committed to doing whatever it takes to build the next generation of sustainable, scalable market winners. For our LPs, this means a portfolio positioned to outperform, powered by a team that is uniquely equipped to de-risk, accelerate, and elevate every venture we back.

The Wave Hanson difference is that we’re not just writing checks – we actively partner with entrepreneurs. We understand that early-stage founders, especially in sustainability, face unique challenges: whether it’s getting a pilot with a big industrial customer, applying for government grants, or protecting IP in deeptech. We’ve been through these and can guide our founders through the maze. One of our values is “do whatever it takes to help the founder succeed,” and we mean it – if an introduction to a potential client or key hire can change a company’s trajectory, we will move mountains to make it happen.

Our value-add platform, while still growing, includes:

Mentorship and Advisory Board Building: We help startups assemble advisory boards with industry veterans early on, lending credibility and expertise. Often a well-placed expert (like a former VP at a target customer company) can open doors and shorten sales cycles.

Talent Recruitment: Leveraging our network in the sustainability and tech communities, we assist in recruiting missions for critical roles (early engineers, product managers, bizdev leads). We know the talent market and often can source mission-driven individuals excited to join our portfolio companies.

Business Development and Partnerships: We frequently play a quasi-BD role, making introductions to potential customers, distribution partners, or strategic investors. For example, if a startup makes a new water filter for industrial use, we might introduce them to contacts at a large beverage company or a municipal water utility we know is forward-looking. These intros can lead to pilot projects or commercial contracts that validate the startup and drive revenue.

Follow-on Fundraising: We help our companies craft their story and metrics for the next round. We will pitch in to refine pitch decks, practice Q&As, and leverage our contacts at Series A/B venture firms to secure warm intros. Since we co-invest and have a collaborative ethos, we often bring in trusted co-investors at seed, which sets up a supportive investor syndicate for the long haul.

Impact Measurement and Communication: Because we focus on impact-native companies, we assist them in establishing solid impact measurement frameworks (like lifecycle analyses, reporting tools) and communicating that impact to stakeholders (which can attract customers, press, and investors). For instance, we might help a packaging startup quantify how much plastic waste they avoid and turn that into a marketing message or an investor KPI.

All of these value-adds serve one goal: amplifying the growth and value of our portfolio companies. We believe our hands-on approach can give us an edge in winning deals too – the best founders often choose investors not just for money but for how useful they’ll be. Our reputation is building as the go-to fund for sustainability startups that want active support and knowledgeable partners. We are proud that entrepreneurs refer others to us because “Wave Hanson will roll up their sleeves and help you succeed.” This is perhaps our greatest asset.

Finally, a note on values and culture: Wave Hanson is named in part to evoke the idea of a wave – dynamic, powerful, driven by nature. We foster a culture of integrity, collaboration, and optimism. We are mission-aligned with our founders; we celebrate their breakthroughs and stand by them in challenges. LPs can trust that we operate with high ethical standards – transparency, honesty, and a long-term relationship mindset. This often translates into stronger networks and deal flow (founders who had a good experience will refer others; co-investors enjoy working with us). The core team’s diversity of background and thought (we come from different countries and industries) also helps us avoid groupthink and spot opportunities others miss. We share a unified vision that profitable business and planetary well-being are not in conflict but mutually reinforcing, and we intend to prove that through the success of Wave Hanson Fund I and beyond.

Conclusion: The Future is Sustainable – and Profitable

In summary, Wave Hanson’s investment thesis is that sustainability at scale is the next big lucrative opportunity and money-maker in venture capital. We live at a time when doing what’s right for the planet – building climate solutions, conserving resources, regenerating nature – also aligns with massive consumer demand, technological feasibility, and economic advantage. The startups that embody this convergence are poised to become the market champions of the coming decade, in the same way that internet and software startups dominated the last two. By investing early in these sustainability winners, Wave Hanson will not only deliver substantial returns to our investors, but also help accelerate the transition to a cleaner, more resilient global economy.

Our focused thesis (cheaper, sustainable, scalable), our hands-on “select-scale-sell” strategy, and our experienced team form a cohesive approach to capture this opportunity. We have identified the key sectors and are already partnering with extraordinary founders who meet our high bar. As we deploy capital, we will maintain discipline to ensure each portfolio company has the DNA to become a leader with both competitive moats and impact moats.

For our limited partners, this is a chance to be part of something special: a fund that is small enough to be agile and deliver high multiples, yet ambitious enough to tackle global challenges and back world-changing companies. We are targeting top-tier financial performance by backing businesses that inherently make the world better – a truly sustainable venture strategy in both senses of the word.

We believe that in 5–7 years, when we look back at Wave Hanson Fund I, we will count multiple category-defining companies in our portfolio, stories of ideas that went from prototype to global scale, and exits that solidify the thesis that sustainability wins. We invite you to join us in this journey – to fund the next wave of great startups that will ride the crest of the sustainability revolution and, in doing so, generate tremendous value for all stakeholders. The time to invest in a brighter, more profitable green future is now, and Wave Hanson is poised to lead the way.

Soon, it’ll be time for Fund II.